Fund Story

Deal Example

Strategy

Structure

- Sourcing Deals

- Underwriting Experience

- Priority Is Value Add

- Management Affiliations

- Strategic Exits

- Delaware Llc Entity

- $50,000 Minimum Investment

- 3-7 Years Project Hold Time

- An Offering Under - Reg D, Rule 506(C)

Why Self-storage?

Consistent Demand: Self-storage facilities typically experience steady occupancy rates because people constantly need extra space for personal, business, or seasonal storage, leading to reliable income streams.

Recession-Resistant: Self-storage is considered resilient during economic fluctuations because individuals and businesses still require storage solutions regardless of economic conditions.

Third-Party Management: Self-storage facilities can be managed by specialized third-party companies, reducing operational burdens for investors and ensuring professional day-to-day management and maintenance.

Low Operating Costs: Compared to other real estate types, self- storage properties often have lower operating expenses due to minimal management needs and fewer repairs, resulting in higher profit margins.

Ancillary Revenue Streams: Beyond just rental income, opportunities exist for ancillary services such as selling packing supplies, insurance options, or offering climate-controlled units for higher-margin tenants.

Flexible Pricing Strategies: Multiple units allow for dynamic pricing adjustments based on demand, seasonality, or tenant type, helping to optimize revenue throughout different market conditions.

Available Financing Options: Many lenders recognize the stability and profitability of self-storage properties, offering favorable financing terms, including competitive interest rates and adjustable loan options, to facilitate investment growth.

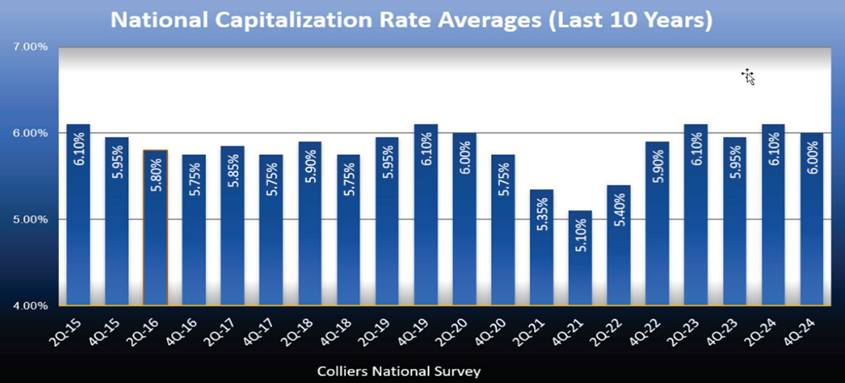

Historically Low Cap Rates: Self-Storage properties have traditionally exhibited low capitalization rate, reflecting their reputation as stable and reliable investments with strong demand and consistent cash flow.

Diversification of Tenant Base: Having multiple units reduces dependency on a single tenant or a small group, thereby spreading occupancy risk and minimizing potential income disruptions.

Projected Returns

Investors will have the opportunity to designate their investment funds into specific deals. The projected returns for each deal will vary based on the level of perceived risk, value creation potential, and additional deal-specific, market, and external factors.

6-12% IRR

Stabilized Facilities

14-22% IRR

Value Add Deals

16-25% IRR

Development

Properties may be sold collaboratively. This will be evaluated on a case by case basis.

Fees

The Fund may receive reimbursements for pursuit expenses and other fees needed to acquire and oversee deals, and may accept some or all of the following fees from deals on a deal by deal basis, which will be noted in each deal disclosure:

Acquisition

Equity Raise

Construction MGMT

Asset Based

Property MGMT

Administration

Disposition

Fund Overview & Objectives

This summary includes excerpts from the PPM and is intended only as an overview. It does not include all Fund terms-review the full PPM before investing. Non-members must read the entire PPM before investing or allocating funds to any investments. Members should review this summary alongside each Deal Disclosure before making allocation decisions.

Financial Disclosures

- Deal Disclosures may include data on past performance.

- Past performance does not guarantee future results.

- Current results may be higher or lower than the performance data presented.

- Return examples are based on assumptions, trends, and competitive comparisons.

- There are no guarantees regarding the accuracy or reliability of any past performance data.

Financial Projections

- Some Deal Disclosures may include forward-looking projections and forecasts.

- These are based on assumptions and hypothertical scenarios, which may not materialize.

- The Fund Manager makes not representations or warranties about the accuracy of any projections

- Actual performance will likely differ from projections.

- The Fund Manager does not guarantee that any investor will achieve projected or modeled returns.